How Climate Change Could Impact Your Retirement

The ongoing climate crisis makes so much about the future uncertain.

How much will a cup of coffee cost 10 years down the road? Which wines will still be on the market as rising temperatures make some grapes harder and harder to grow?

What's going to count as "coastal real estate" in 40 years?

With so much on the line, it’s hard to not worry about what the future is going to look like.

But at the same time, the clock is still ticking. With every day that passes, we're all one day older – and one day closer to retiring.

Planning for retirement has been a challenge in the best of times. But now, with so much about the future uncertain, where do you even start? And is there a way that your investment can help fight the climate crisis at the same time that it builds your golden-years nest egg? (Hint: The answer is "yes"!)

Factor In Climate Change

Warm, beachy spots on the Atlantic, Pacific and Gulf coasts, as well as the desert southwest, have been retirement magnets for many Americans for decades. But sought-out locations like these are squarely in the crosshairs of many of the worst climate change impacts. Some are experiencing them already – with the worst yet to come (unless we act now to create the necessary change).

Extreme weather events such as hurricanes, droughts, heat waves, and floods are expected to become more common as global warming continues to throw natural systems out of balance.

According to climate scientists at Columbia University’s Earth Institute, “Current climate and future climate is absolutely something that people should be thinking about when deciding where to live, where to retire.”

Popular retirement destinations like Florida and Arizona could face some of the worst effects of climate change. Arizona is already seeing periods of record heat and is expected to continue to warm as the crisis escalates. In addition to high heat, Florida faces other serious impacts: in recent years, hurricane activity has been on the rise. Also on the rise? The seas that surround the peninsula, which is home to over 21 million people.

>> Free download: Learn more about extreme weather and what you can do. <<

Because of this, those same scientists warn, there “are absolutely critical concerns when you think about impacts directly on the home, but also livability outdoors — things like critical infrastructure.”

When deciding on where you want to retire, be sure to consider future regional climate impacts for the area. If you live in the US, state-by-state climate change information can be found here.

You may also want to ask yourself a few questions:

- How might an extreme weather event affect me?

- Will I be forced to evacuate every summer or fall because of hurricanes or wildfires? How will this impact my quality of life?

- Will I be able to get a reasonably priced insurance policy to protect my house from weather and climate disasters?

- What kind of financial burden will I have in fixing or protecting my home from weather and climate problems?

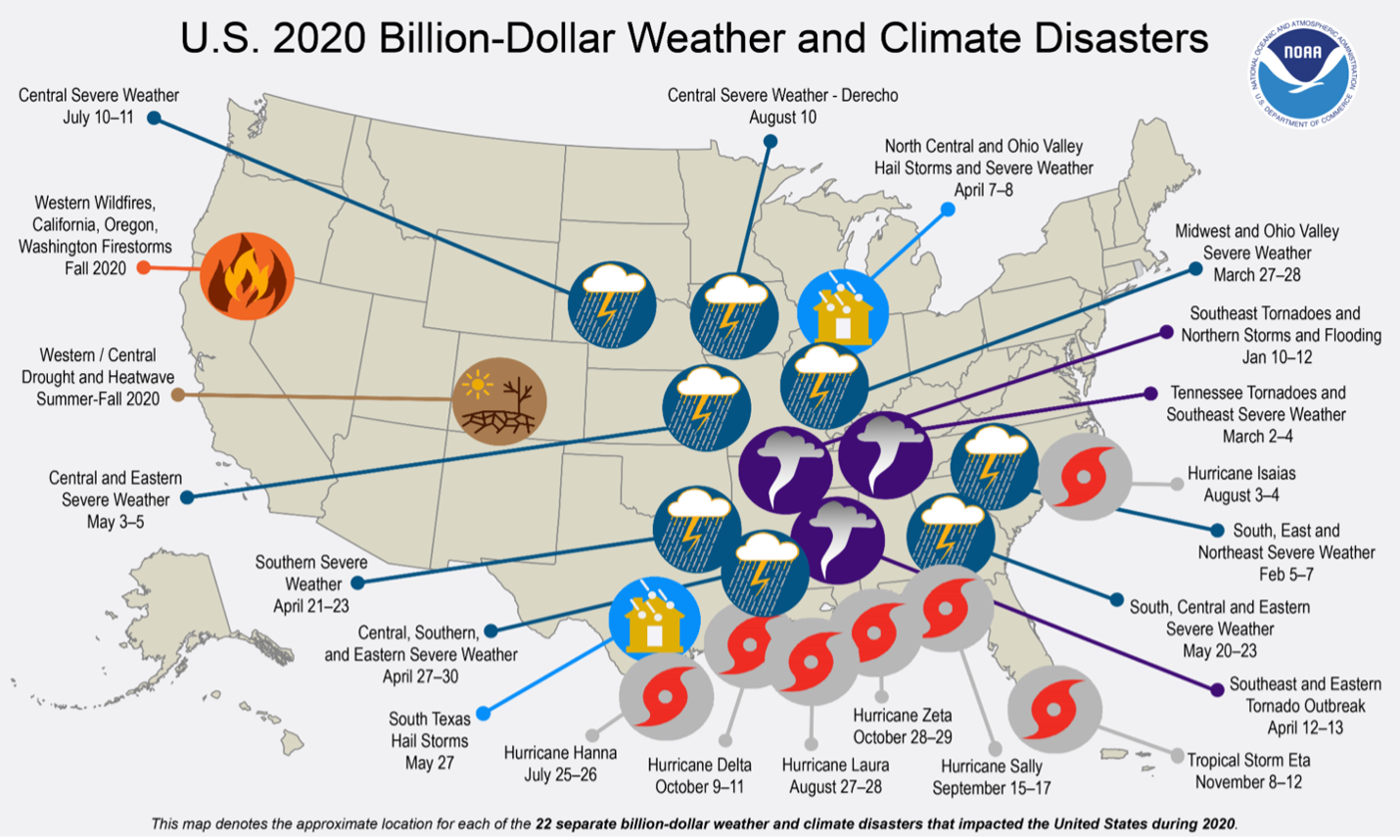

Keep in mind, in 2020, there were 22 separate billion-plus-dollar climate and weather disasters in the US:

Climate-Smart Investments

Every two-weeks, many Americans put aside a portion of their paychecks into a retirement plan. But did you know there are workplace retirement plans out there that help flight climate change?

Over past few years, socially responsible funds have grown in popularity as investors take the threat of the climate crisis more and more seriously.

Socially responsible, or “impact,” investing is built on the premise that where you invest your money matters. It’s the idea that if you want the world to be a better place — socially, environmentally, or however you define it — you should invest in companies that operate under those same ideals.

There’s even a popular idiom for it: “Put your money where your mouth is.”

>> Be part of the change your community needs. Join a Climate Reality chapter near you. <<

Amy Zalman, CEO and founder of Prescient, says, “If you do have actual money to invest, put it in places, small and large, where people are really thinking about how to make the earth sustainable.”

This is the place where many of you are no doubt saying, “That sounds great – but you can’t get as good of a return on investing for impact.” But this is simply not true.

According to American financial service firm Morningstar (via CNBC), in 2018, sustainable funds outperformed benchmarks, with 63 percent landing in the top half of their categories.

“There’s really no evidence out there that [sustainable investing] is an underperforming way to invest,” said Jon Hale, head of sustainable investing research at Morningstar.

The firm notes there roughly 300 environmental, social, and governance (ESG) funds.

These socially responsible funds have seen decent success, but most of these fund are actively managed and can come with some higher associated fees than passive investments. And gains are uncertain, though that's true across all investing.

Climate-Smart Retirement Plans

Currently, less than 3 percent of 401(k) plans offer an ESG fund as an investment option for employees, according to the Plan Sponsor Council of America, a group that represents companies offering workplace retirement plans.

A fraction of all 401(k) assets—about one tenth of 1 percent—are held in these socially responsible funds.

Part of why is that most people invest their 401(k) into target date funds—all-in-one funds that shift from stocks to bonds as investors approach retirement age—leaving little room for other types of investments to get much air.

To find out if your pension or 401(k) is invested in ESG funds, ask your human resources person. If it is not, consider furthering the discussion with your HR person and co-workers.

Through greater participation in these funds, millions of dollars can be diverted from companies that warm the planet to those looking to save it.

What Can You Do?

At the end of the day, on this planet, at this time, an unfortunate truth remains: money makes the world go ‘round.

That’s why we’ve long suggested that when it comes to climate action, you do your best to “speak with your wallet.”

One of the most basic and potent forms of power we have is our ability to decide where and how we spend our money. When you support farmers, businesses, and investment funds that themselves undertake or otherwise support the kinds of climate action that will lead us down the road toward a just, sustainable tomorrow for all powered by clean energy, you’re providing that business with the fuel to keep up its good work—and you’re showing other corporations, brands, and banks that there is an important (and growing!) consumer base for whom business as usual will not cut it.

Because the truth is, if we want a safe future for our families and our planet, we’ve got to make the choices that get us there. Not tomorrow. Not a few months or years down the road. Right now.

Start your personal journey as an activist out to stop the climate crisis and help communities everywhere as part of our Climate Reality Leadership Corps by attending our upcoming virtual US training.

Learn from Climate Reality’s founder and chairman, former US Vice President Al Gore, renowned climate scientists, expert storytellers, and engaged community activists how we can seize this important moment and work toward a cleaner, greener, and more-just future for all of us.

If you are interested in US climate advocacy in 2021 and beyond, register now for our US virtual training.

If you are outside of the US, please consider signing up to learn more about our future virtual training events coming up later in 2021.